We're reimagining insurance

as a force for social and environmental good.

Insurance for Good is a non-profit serving as the community of practice working to harness risk transfer for the common good.

We partner with communities and the public sector to curate shared resources, deliver capacity-building programs, incubate open-source and innovative risk transfer approaches, and partner for improved policy and regulation that achieve social and environmental goals.

The problem.

The interconnected challenges of climate change, rising inequality, and nature loss are increasing risks across the economy and require action by all sectors.

Climate change is breaking insurance markets just as we need them more than ever and vulnerable populations lack the coverages they need.

Insurance can be a lever to drive change in other sectors and to facilitate needed investments, yet such approaches and products are currently limited.

Efforts to harness insurance for positive change are fragmented, many groups lack needed capacity, and incentives for innovation may be misaligned.

Our solution.

Insurance for Good is assembling the community of practice working to harness insurance as a tool for change.

Shared resources.

capacity building.

open-source innovation.

POLICY and regulatory reform.

Explore how insurance can help us manage climate risk, secure equitable recoveries, and expand nature-positive investments.

increasing resilience

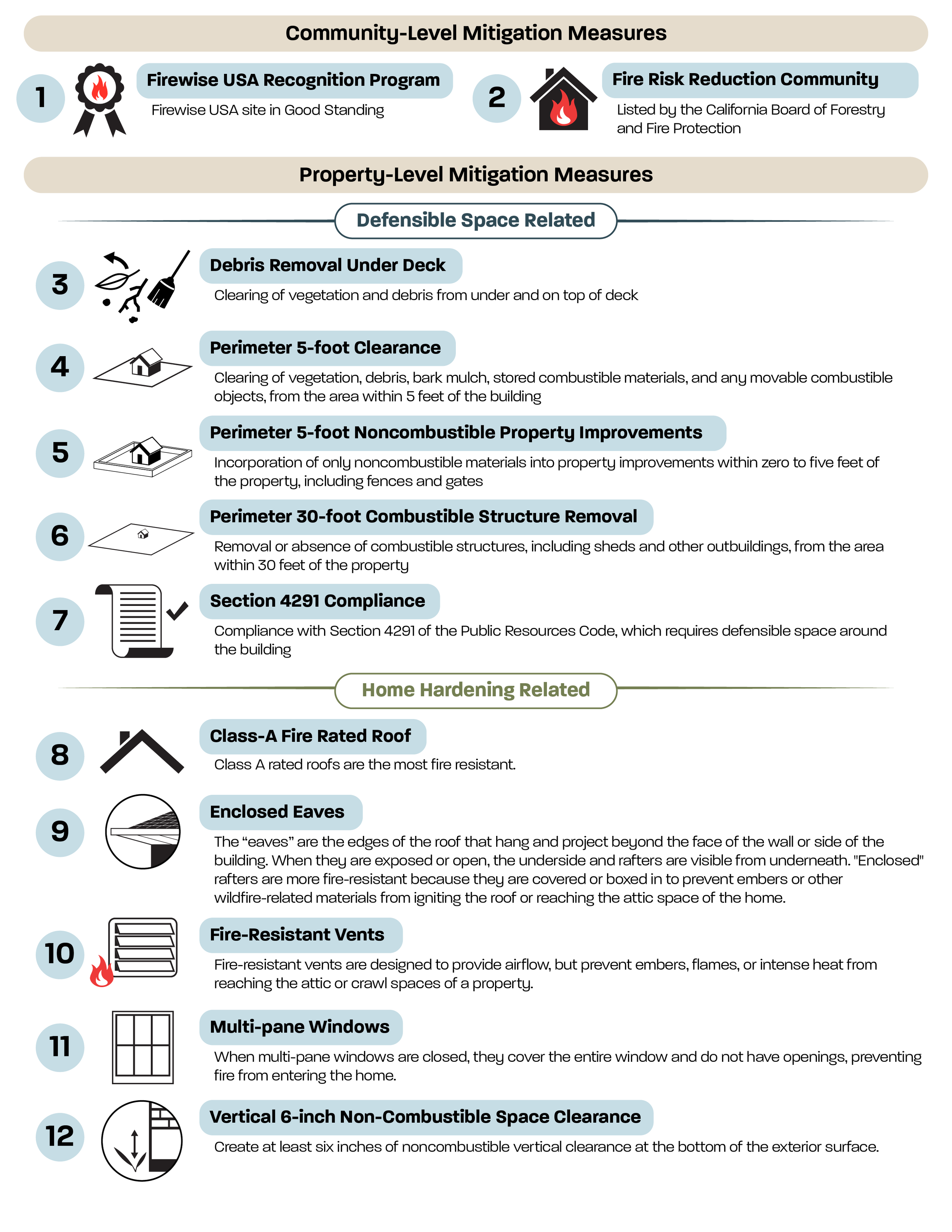

Utilizing insurance to support more significant investments in risk reduction and resilience both before and after disasters.

Improving Equity and Inclusivity

Developing appropriate and affordable policies and programs to enhance equity in disaster recovery and inclusivity in insurance markets.

Driving Decarbonization

Accelerating energy transition efforts at scale across sectors.

Protecting Nature

Harnessing risk transfer for conservation, restoration, and other nature positive actions.

NEW! Download Rebuilding Safer from Wildfire: Implementation Guidebook for a Post-Fire Resilience Delta Grant Program

Featured publications.

"Risk transfer has an important role to play in the transition to a resilient, carbon-free, sustainable, and equitable economy...

“The next few decades are going to increasingly be dominated by risk management. As threats grow, it will be the ability to effectively understand, reduce, and transfer these risks that will allow households, businesses, and communities to continue to thrive and maintain their well-being.”

— Carolyn Kousky in Understanding Disaster Insurance

In the news.